missouri gas tax refund

Individuals who earned more than 100000 and couples. Mike Parson signed SB 262 into action last year.

Missouri Drivers Can Claim Gas Tax Refund With Receipts On July 1

25 cents in 2022.

. Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025. Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program. The bill also offers provisions that allow Missourians to request.

75 cents in 2024. When the state of Missouri passed a law to increase its gas tax lawmakers also promised a refund to Missourians. Missouris gas tax is currently 195 cents a gallon and hasnt.

Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The bill passed in 2021 says Missouri drivers who keep their gas receipts between October 1 2021 and June 30 2022 can request a full refund of the additional taxes paid.

5 cents in 2023. For on road purposes. The gas tax will go up 25 cents every year for the next few years until the gas tax reaches about 30 cents per gallon in Missouri.

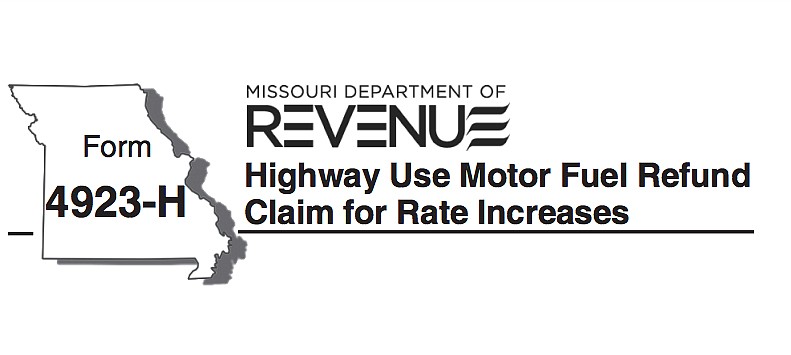

The Missouri gas tax rises to 195 cents per gallon Friday. The form called Form 4923-H is available online through the DORs website. 75 cents in 2024.

News Sports Entertainment Lifestyle Opinion USA TODAY Obituaries E-Edition Legals. There are about 700 licensees including suppliers distributors transporters and terminal operators. Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used.

1 2021 through June 30 2022. Residents who earned under 100000 in 2021 will get a 300 tax rebate this year with dependents eligible for the rebate as well. Drivers can claim a refund on last years 0025 gas tax increase.

Missouri residents are now paying a higher gas tax. Missouri drivers can start submitting refunds to receive the money they spent on a state gas tax just as the tax increases July 1. Last year the Missouri legislature passed a 25-cent fuel tax increase effective Oct.

Please refer to the Motor Fuel Tax Non-Highway Form Updates for more information. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. Despite the form being available filing is not allowed until July 1 and will run through Sept.

Fuel bought on or after Oct. It will rise to 22 cents per gallon on July 1 and eventually end at 295 cents per gallon in 2025. Ad Edit Fill eSign PDF Documents Online.

The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road construction and maintenance. The Center Square Missourians can begin completing documents to reclaim the 25 cents per gallon motor fuel tax paid during the last nine months. The states additional gas tax went up to five cents a gallon July 1.

Consumers may apply for a refund of the fuel tax when fuel is used in an exempt manner See the Motor Fuel FAQs for more. 25 cents in 2022 5 cents in 2023. Missouri officials said in April they would be releasing a form for gas tax refunds in May and it was released on May 31.

Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct. There is a way to get a refund on the increase. One of the laws selling points was any Missourian who didnt want to pay the increase could keep their receipts and.

2 days agoThe state has received an estimated 500 refund claims for the 25-cent-per-gallon motor fuel tax increase that took effect in October 2021 but the Missouri Department of Revenue said its too. Form 4923 must be accompanied with the applicable Form 4923S Statement of Missouri Fuel Tax Paid for Non-Highway Use. Senate Bill 262 allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually.

Missouri resident Michael Cromwell said the increase in gas prices is really painful to hear and he encourages Missouri. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. Vehicle for highway use.

Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. With the passage of Senate Bill 262 the Missouri Department of Revenue made changes to some of the forms used when requesting a refund of taxes paid on Missouri motor fuel used for non-highway purposes. 25 cents in 2022.

Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. Vehicle weighs less than 26000 pounds.

Refund claims must be postmarked on or after July 1 but no later than September 30 following the fiscal year for which the refund. Under SB 262 you may request a refund of the Missouri motor fuel tax increase paid each year. 5 cents in 2023.

Missouri will raise the gas tax 25 cents each of the next three years after Gov. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. Professional Document Creator and Editor.

The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts. The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts. The news of this refundable gas tax has been widely reported.

Missouris gas tax currently sits at 195 cents per gallon among the lowest rates in the country. Check For the Latest Updates and Resources Throughout The Tax Season. Missourians will be eligible to receive their first refund on July 1 2022.

Your New Car Is Keeping You Broke It S Time To Realize That You Don T Need A New Car To Commute From Home To W Tax Refund Money Activities Financial Education

Why The 2022 Tax Refund Backlog Could Delay Your Payment

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri Gas Tax Refund Forms Now Available Local News Bransontrilakesnews Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Local News Online Gas Tax Refund Claim Form Now Available 6 3 22 Southeast Missourian Newspaper Cape Girardeau Mo

Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund

State To Begin Accepting Gas Tax Refund Claims

The Average Tax Refund Is 300 Higher This Year Money

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

How To Get Your Gas Tax Refund By Using Forms From The Missouri Department Of Revenue

Four Reasons Some Americans Never Get A Tax Refund This Nation

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

New App Gears Up For Missouri Gas Tax Refund Ksdk Com